Last updated on June 16th, 2025 at 12:20 am

Top 5 Platforms to Get a Loan in 5 Minutes in Zambia (Tested & Rated)

We tested Zambia’s most popular instant loan apps and services. Here’s a summary of how each one performs. Use the action buttons to apply directly.

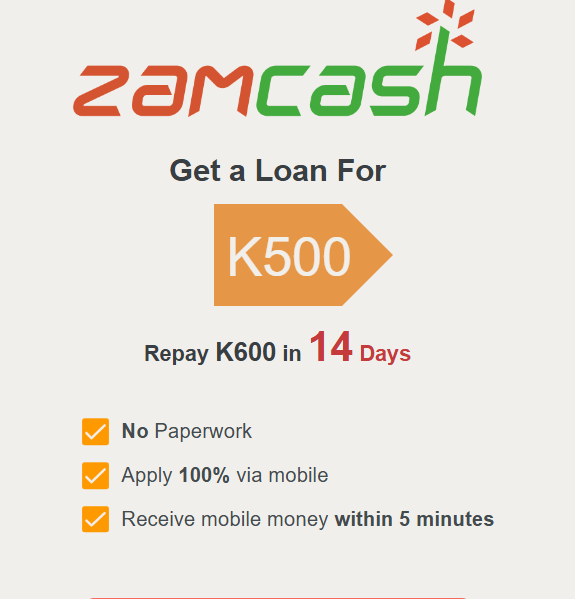

1. Zamcash – Fastest Approval & Easy to Use

Approval Time: Under 3 minutes

Loan Method: Web & mobile

Best For: Quick cash on MTN or Airtel

Why We Recommend Zamcash:

Zamcash is the fastest online loan platform in Zambia based on our testing. You don’t need to download an app. Just visit their website, fill in your NRC, phone number, and requested amount, and your loan is approved instantly if you qualify. Their interface is user-friendly, and they show the total repayment upfront.

Pros:

- Instant approval in under 5 minutes

- No app required

- Transparent fees

- Works with Airtel Money and MTN MoMo

Cons:

- Limited support for first-time users

- Smaller loan limits for new borrowers

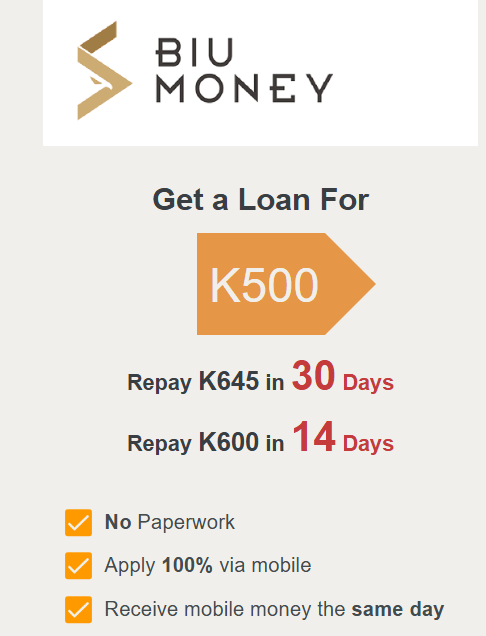

2. BiuMoney – Best for Web-Based Loans (No app Needed)

Approval Time: 5 minutes

Loan Method: web

Best For: Airtel users and MTN users

Why We Recommend Biu Money:

BiuMoney lets you apply for a loan using web, which makes it perfect for people with old phone that don’t support the apps. It’s ideal if you need money urgently and can’t download the app. The process is straightforward, and their response time is fast. They also provide a breakdown of fees before you accept the loan.

Pros:

- No app needed

- Simple to use for everyone

- Fast disbursement to Airtel Money and MTN

Cons:

- Limited to Zamtel network

- Smaller loan amounts

PowerKwacha – Good Option with Slightly Slower Approval

Approval Time: 7–10 minutes

Loan Method: APP

Best For: Personal loan and android app users

Why We Recommend PowerKwacha:

PowerKwacha offers mobile loans with a simple application process. While it’s not the fastest platform we tested, it still delivers within 10 minutes for most users. It works well for small personal loans, especially if you’re not in a rush. However, the user interface could be more modern, on one time login code send via SMS

Pros:

- Decent approval speed

- Reliable for repeat borrowers

- Supports multiple networks

Cons:

- Required an app to borrow

- Delay on login code send via SMS

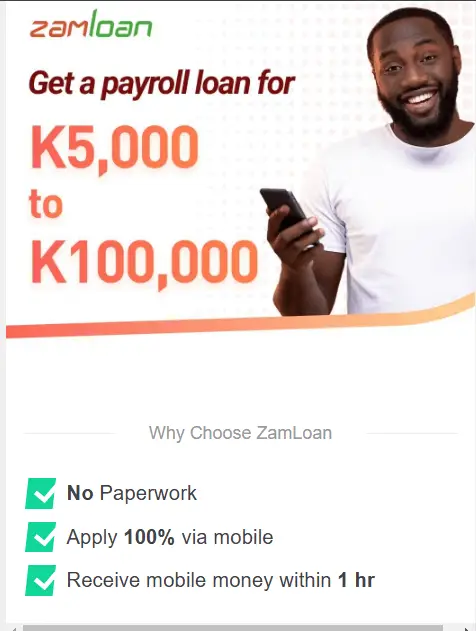

Zamloan – Transparent Terms and Moderate Speed

Approval Time: 1 Hour

Loan Method: Website

Best For: Users who prefer clarity before borrowing

Why We Recommend Zamloan:

Zamloan is a good option for users who value transparency. The platform explains its interest rates, terms, and repayment timelines upfront. Approval is reasonably fast, and the platform works well on both mobile and desktop browsers. It’s especially good for larger loans.

Pros:

Offer larger loans

Clear interest rates

Mobile-friendly

Cons:

- Slightly slower approval

- May require more details for larger loans

Lupiya – Trusted Name with Strong Security, But Slower

Approval Time: 48 Hours

Loan Method: Web & App

Best For: Secure, longer-term loan needs

Why We Recommend Lupiya:

Lupiya is one of Zambia’s most trusted fintech platforms. While it doesn’t provide the fastest loan approvals, it offers a secure and transparent process with clear loan terms. It’s great for users looking for slightly larger loans or those wanting more trust in the service.

Pros:

- Reputable and secure

- Very transparent with fees

- Offers flexible repayment plans

Cons:

- Longer wait time for first loans

- More detailed application process

The Need for Speed in Financial Solutions

In today’s fast-paced world, accessing emergency funds can be critical. Whether it’s for rent, school fees, or unexpected bills, many Zambians need a way to get quick loans without long wait times or paperwork. Fortunately, mobile technology now makes it possible to get a loan in 5 minutes in Zambia using your phone or laptop.

Understanding the Loan Landscape in Zambia

Zambia offers several types of loans tailored to various financial needs:

Personal loans: For household expenses or emergencies.

Payday loans: Short-term loans to cover expenses before your next salary.

Microloans: Small loan amounts for informal businesses or individuals.

Most lenders now operate digitally, making the process faster and easier than ever.

The Rise of Instant Loan Services

Digital lending platforms in Zambia have revolutionized borrowing. Instead of waiting days or filling out forms in person, users can apply online or via USSD. Services like Zamcash and Biu Money use smart technology to approve and disburse loans in under 5 minutes.

How to Prepare for a Quick Loan Application

To get a loan in 5 minutes, prepare the following:

- A valid NRC number

- A mobile number linked to Airtel Money or MTN Mobile Money

- Basic income information

- Your residential address

Having these ready can speed up your approval.

Step-by-Step Guide to Applying for a Loan in 5 Minutes

- Visit the lender’s website or download an app

- Enter your details (NRC, phone number, amount)

- Wait for instant approval decision

- Accept loan terms and confirm via SMS or on-site

- Receive funds in your mobile wallet within minutes

Pro tip: Use accurate info and avoid multiple applications in one day.

Understanding Interest Rates and Fees

Interest rates in Zambia vary by lender. Instant loans usually charge higher rates due to their short-term nature. Look out for:

- Flat fees per loan

- Daily or monthly interest rates

- Late payment penalties

Always read the loan agreement carefully before accepting.

The Importance of Responsible Borrowing

While instant loans are helpful, borrowing beyond your means can lead to debt traps. Stick to these principles:

- Only borrow what you need

- Prioritize repayment before due dates

- Track your borrowing history

- Avoid taking multiple loans at once

Responsible borrowing keeps your financial health strong.

Real-Life Success Stories: Quick Loans in Action

Banda (Lusaka): “Zamcash helped me pay rent on time. I got the money in 5 minutes—no stress.”

Samuel (Kitwe): “I didn’t have fuel but used BiuMoney via website. The process was fast and simple.”

Kasongo (Ndola): “Zamloan was clear with their terms. I trusted them and repaid within 30 days without issues.”

Make Smart Choices When Borrowing

Getting a loan in 5 minutes in Zambia is now possible thanks to digital lenders. These platforms are fast and reliable, but choosing the right one is key. Always compare options, check the total repayment, and borrow only what you can afford to repay.

Ready to apply? Scroll back to the top and choose a lender to get started.

Pingback: Instant mobile money loans in Zambia – Loans in Zambia

I need a loan please

Hi Fransis,

Thank you for reaching out. If you need a loan, you can apply through trusted platforms like Zamcash, Zamloan, and Biumoney.

Please visit our guide at https://loansinzambia.com to compare options and start your application. The process is fast, simple, and 100% online.

If you need help choosing the best loan, feel free to reply here or contact us through the website.

Best regards,

Loans in Zambia Team

309415 /13 /1

Thank you for your comment, Mary. It seems your message was incomplete. If you’re requesting a loan or have a specific question, kindly provide more details so we can assist you better. You may also browse verified lenders on our site.

Loans in Zambia Support Team

I need a loan

Thank you for reaching out, Francis. If you need a loan, please visit our Loans interest rates comparison Page to explore trusted lenders available in Zambia. We list lenders who offer personal, business, and emergency loans. Make sure to check the requirements and terms before applying. If you need help choosing the right option, feel free to contact us.

Loans in Zambia Support Team